XRP has experienced a surge in open interest, rising 17% to hit approximately $10.37 billion. This uptick comes amid heightened trading activity following a Ripple whale move of $173 million.

Amid these whale transfers, XRP price has enjoyed bullish momentum breaking resistances and eyeing an all time high soon.

XRP Open Interest Surges Over 18%

XRP’s open interest has risen by 18%, marking a significant increase to $10.52 billion. This push indicates that traders expect greater price volatility in the short term, and most are loading up to take advantage of the recent bullish trend in XRP.

XRP derivatives volume also increased by 139.84%,to $39.61 billion reflecting the growing interest in XRP as it pushes past resistance levels.

Against this optimism, an XRP whale transferred $173 million (53,477,932 coins), which caught the attention of analysts. The transaction, which has been made by a Ripple whale, has triggered speculation regarding the market direction and possible selling pressure. This transfer has followed the recent transaction of Ripple co-founder Chris Larsen who transferred approximately $26 million in XRP to Coinbase.

Analyst Predicts 630% XRP Price Rally

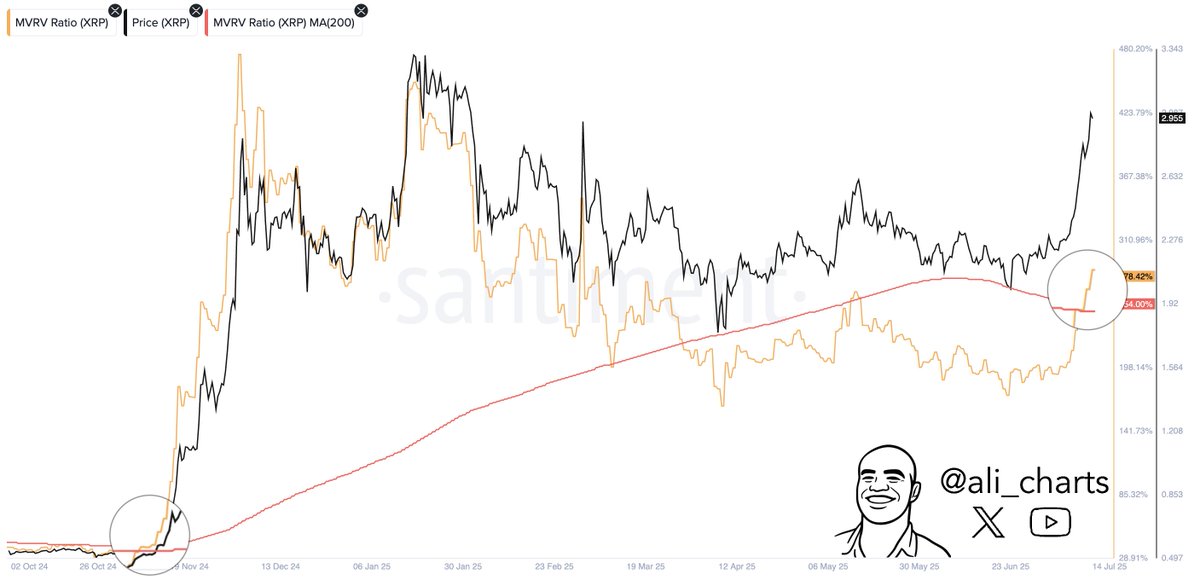

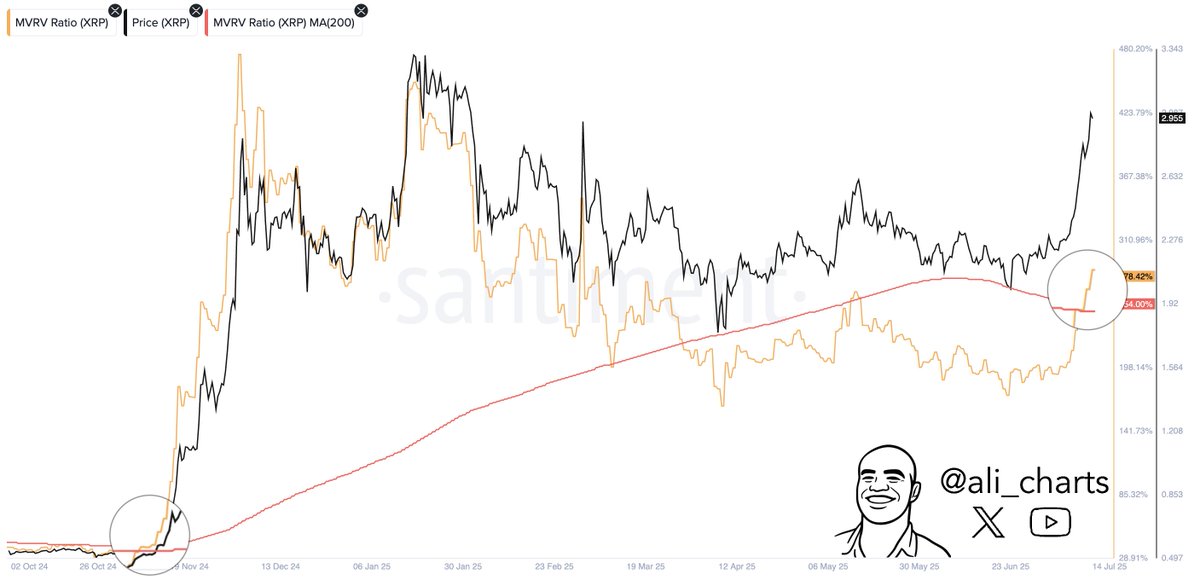

Crypto analyst Ali Charts has shared a positive signal for XRP price trend based on the MVRV ratio. According to Ali, the last time the MVRV ratio displayed a golden cross, XRP soared by 630%. This indicator has now flashed again, signaling that XRP could be on the verge of another major upward movement.

This analysis aligns with XRP’s current momentum, which has seen the token rise by 35% over the past week. Moreover, as of press time, XRP price was trading at $3.47, a 13.50% rally from the intra-day low.

Moreover, the appearance of the golden cross indicate a continued bullish trend. In addition, speculation about the launch of the first U.S.-listed XRP ETF is also driving excitement in the market. Expectation are swirling that ProShares could launch an XRP ETF tomorrow could fuel XRP price rally to a new ATH..

Crypto Bills Pass Fuel XRP Rally

The passing of the CLARITY Act in the U.S. House of Representatives has generated optimism for the Ripple token. The bill aims to establish clear regulations for digital assets, a move that could provide much-needed guidance for the cryptocurrency market.

The CLARITY Act, along with other 2 crypto-related bills, suggests that the regulatory environment for digital assets is becoming more structured.

Bouyed by the optimism, XRP’s market cap has risen by over 12% in the past 24 hours crossing the $200B mark. Clearer regulations are seen as a positive for Ripple, which has faced ongoing legal challenges in the U.S.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

✓ Share: