From Chinese electronics to Canadian yoga wear, shoppers are buying now to avoid paying more later

Article content

Article content

Article content

Americans are rushing to stock up on everything from soy sauce to Lululemon Athletica Inc yoga gear before the tariffs imposed by President Donald Trump start to jack up prices on the shelves, according to media reports.

The day after Trump’s so-called Liberation Day last Wednesday, billionaire businessman Mark Cuban posted a warning to Americans on social media platform Bluesky.

Advertisement 2

Article content

“It’s not a bad idea to go to the local Walmart or big box retailer and buy lots of consumables now. From toothpaste to soap, anything you can find storage space for, buy before they have to replenish inventory,” Cuban wrote.

“Even if it’s made in the USA, they will jack up the price and blame it on tariffs,” he added.

Clothing industry groups also warned that American consumers should expect to pay more for clothes and shoes, about 97 per cent of which are imported, mainly from Asia.

Most of the clothing sold at Gap Inc., Lululemon and Nike Inc. are made in Asian countries, which face the stiffest tariffs. Under the president’s plan to punish countries for trade imbalances, Vietnam was slapped with an import tax rate of 46 per cent and Bangladesh and Indonesia, 37 per cent and 32 per cent.

With U.S. companies, which use foreign factories to keep labour costs down, and their overseas suppliers unlikely to absorb new costs this high, price hikes look inevitable.

“If these tariffs are allowed to persist, ultimately it’s going to make its way to the consumer,” Steve Lamar, president and CEO of the American Apparel & Footwear Association, told The Associated Press.

Article content

Advertisement 3

Article content

Trump’s tariff announcement last Wednesday spurred Americans across the country to hit the stores or load up their “carts” online, reports the Wall Street Journal.

For many people the Rose Garden event flicked the switch from threats to reality, Peter Atwater, an adjunct economics lecturer at William & Mary, told the WSJ.

“Just like Tom Hanks getting COVID was the tipping point five years ago,” he said.

Noel Peguero of Queens told the Journal that between Wednesday night and Thursday morning, he spent about US$3,000 on electronics, car parts, gardening equipment and other household items.

“Now is the time to buy,” he said.

Others stocked up on foreign brands like Lululemon and food — everything from Guinness to soy sauce.

One Reddit user from Illinois told Business Insider that his spending would come to “a complete standstill” for things that aren’t essential. Imports like fruit, avocados, and tea, “are all a luxury now,” he said.

A poll of the Business Insider newsroom revealed that people are snapping up Apple Inc. computers, hair extensions from Asia, a trench digging shovel from China and vanilla from Madagascar. One was planting a garden to replace expensive vegetables.

Advertisement 4

Article content

Mary E. Lovely, a senior fellow at the Peterson Institute for International Economics, questions where the United States will be getting its goods now that tariff rates are “astronomical.”

“Will the new ‘Golden Age’ involve knitting our own knickers as well as snapping together our cellphones?” she told the Associated Press.

Sign up here to get Posthaste delivered straight to your inbox.

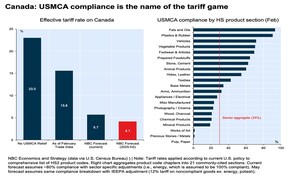

A rush to comply with the Canada-United-States-Mexico Agreement (CUSMA) by Canadian businesses could dramatically reduce America’s effective tariff rate on Canada, said the National Bank of Canada.

According to February U.S. trade data, just 33 per cent of Canadian imports were CUSMA compliant, putting the effective tariff at 15.6 per cent. National economists, however, believe there has been a “rush to compliance” since then that will bring the rate down to 5.7 per cent.

“Sifting through the chaos, it’s clear that USMCA compliance is the name of the tariff game for two of the U.S.’s largest trading partners,” said National economists Stéfane Marion and Ethan Currie.

National expects this rate could come down further as compliance increases, trade composition shifts and special tariffs related to border grievances are potentially removed.

Advertisement 5

Article content

“With rule of trade origin and self-compliance dynamics at play, we expect certain products — such as energy — to become effectively tariff-free, if they aren’t already,” they said.

- The Canadian Association of Petroleum Producers holds its annual investor conference in Toronto

- Today’s Data: United States NFIB small business optimism

- Earnings: Tilray Brands Inc., Walgreens Boots Alliance Inc

For many big bank mortgage borrowers, falling rates can be a double-edged sword.

That’s because they trigger break penalties that banks calculate using “interest rate differentials” (IRDs) which cost Canadians billions every year. Mortgage strategist Robert McLister at MortgageLogic.news explains why falling rates spell trouble for anyone needing to break their mortgage contract. Find out more

Advertisement 6

Article content

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s YouTube channel for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Recommended from Editorial

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Article content