Governor Tiff Macklem warns the economic impact of Trump’s trade war could be severe

Article content

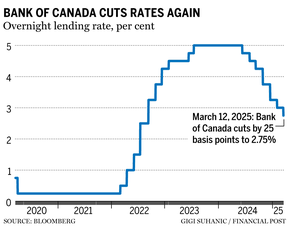

The Bank of Canada cut its key interest rate by 25 basis points on Wednesday, citing trade uncertainty with the U.S. for the decision.

Article content

Article content

“In recent months, the pervasive uncertainty created by continuously changing U.S. tariff threats has shaken business and consumer confidence,” said Bank of Canada governor Tiff Macklem, during opening remarks in Ottawa. “This is restraining household spending intentions and businesses’ plans to hire and invest.”

Advertisement 2

Article content

The decision to cut for the seventh consecutive time on Wednesday was largely expected by markets and economists and brings the central bank’s overnight rate down to 2.75 per cent, in the middle of the bank’s estimated neutral range.

“Depending on the extent and duration of new U.S. tariffs, the economic impact could be severe,” said Macklem.

Watch the Bank of Canada news conference

The central bank estimates a protracted trade war could knock three per cent off Canada’s growth over the next two years. The bank also estimates investment in Canada could decline by 12 per cent and exports could decrease by 8.5 per cent after the first year.

Macklem added that the “uncertainty alone is already causing harm.”

The central bank also published the results of surveys with businesses and consumers on Wednesday, which show how business and household spending sentiment has shifted.

Around 72 per cent of consumers expect costs to go up as a result of tariffs and 47 per cent of businesses think the same, according to a survey conducted between Jan. 29 and Feb. 28.

Around 48 per cent of businesses surveyed plan to reduce their investment plans and 40 per cent plan to pull back on hiring, with just two per cent of businesses saying they will increase investment.

Article content

Advertisement 3

Article content

Macklem said he expects some rise in the unemployment rate, if business investment continues to weaken in the second quarter of this year.

“Our surveys also suggest business intentions to raise prices have increased as they cope with higher costs related to both uncertainty and tariffs,” said Macklem. “At the same time, inflation expectations have moved up as Canadians brace for the possibility of higher prices.”

The bank expects inflation to rise to 2.5 per cent in March, after the end of the GST/HST federal tax break.

Macklem said the impact of tariffs on inflation will be more difficult to assess and will include a number of factors such as a weakening Canadian dollar, the cost of retaliatory tariffs and a pullback in household spending and business confidence.

The central bank said it will continue to monitor inflation expectations closely and how quickly costs incurred by businesses are being passed through to prices.

“The reality is that some prices are going to go up, we can’t change that,” said Macklem. “What we don’t want to see … that first round of price increases have knock-on effects causing other prices to go up, that becoming generalized and ongoing inflation. That’s what we can’t let happen.”

Advertisement 4

Article content

The bank said it will not be able to provide forward guidance given the uncertainty, a decision made during the last announcement in January. It also said the governing council will be “carefully assessing the timing and strength” of downward pressures on inflation from weaker growth and upward pressures on inflation from higher costs.

Randall Bartlett, deputy chief economist at Desjardins Group, said the market reaction following the announcement on Wednesday suggests an April cut is “no slam dunk.”

Tony Stillo and Michael Davenport, economists at Oxford Economics Canada, think the Bank of Canada could cut its policy rate a few more times this year, but will not go below the neutral range.

“We can’t entirely rule out a couple more 25-basis-points rate cuts to cushion against the negative impacts of ongoing uncertainty, but we think it’s very unlikely the bank will lower rates below the bottom-end of its 2.25 per cent-3.25 per cent neutral range estimate given the ongoing U.S.-Canada trade war,” they wrote in a note.

Recommended from Editorial

• Email: jgowling@postmedia.com

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content