Article content

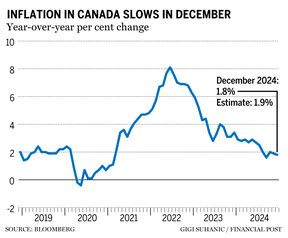

Canada’s inflation rate dropped to 1.8 per cent in December from 1.9 per cent a month earlier, as the impact from a temporary GST/HST break introduced by the federal government tamped down price pressures, Statistics Canada said on Tuesday.

Article content

The tax break, brought in on Dec. 14, had an impact on prices for food, alcoholic beverages, children’s toys, clothing and footwear. As a result, the cost of food purchased from restaurants declined 1.6 per cent year-over-year in December, the first such decline in the index’s history.

Article content

“Roughly 10 per cent of the inflation basket was affected by the tax exemption, with restaurant, alcohol and toys & games prices all seeing price declines on the month,” said Andrew Grantham, senior economist at the Canadian Imperial Bank of Commerce, in a note. “As the tax break came into effect mid-month, a further impact is expected to be seen in January when prices during the full month were subject to the lower rate.”

Prices for alcoholic beverages declined 1.3 per cent year over year in December, after an increase of 1.9 per cent in November. On a month-over-month basis, prices for alcoholic beverages declined by 4.1 per cent, almost tripling the record monthly drop set in December, 2005.

Excluding the impact of the temporary tax break, the consumer price index was up 2.3 per cent in December. The Bank of Canada expected a cooling in inflation as result of the tax break, which is set to end in mid-February. Tuesday’s inflation reading is the last major economic data release before the central bank’s Jan. 29 interest rate decision.

The tariff threat from the United States, however, will hold the most sway in the Bank of Canada’s decision next week, say economists who predict a 25-basis-point cut by the central bank.

Article content

U.S. President Donald Trump Monday floated the possibility of slapping tariffs against Canada on Feb. 1.

“We believe that the heavy overhang of trade uncertainty — possible U.S. tariffs — overrides almost all else,” said Bank of Montreal chief economist Douglas Porter, in a note to clients. “As a result, we suspect that today’s reading is just good enough to allow the Bank of Canada to trim next week, for risk management purposes.”

Prices for gasoline rose 3.5 per cent in December, after a decline of 0.5 per cent in November, due to base-year effects. Prices for shelter increased at a slower pace last month, rising 4.5 per cent year-over-year, compared to an increase of 4.6 per cent in November.

Core inflation, the measures the Bank of Canada prefers to look at when making monetary policy decisions, declined slightly in December. CPI-median rose 2.4 per cent, down from an increase of 2.6 per cent the month before; CPI-trim rose by 2.5 per cent, down from an increase of 2.6 per cent; and CPI-common rose by two per cent, the same increase recorded the prior month.

Recommended from Editorial

Toronto-Dominion Bank senior economist Leslie Preston noted that core inflation has picked up over the past three months and readings should increase in the months ahead.

“This will give the Bank of Canada reason to adopt a more gradual pace of interest rate cuts this year,” she said.

• Email: jgowling@postmedia.com

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Share this article in your social network