Article content

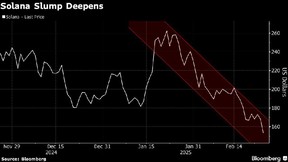

Ether and many of the higher profile altcoins such as Solana and Dogecoin remain under pressure while investors turn elsewhere with the sector still reeling after its biggest-ever hack last week.

Article content

Ether, the second largest cryptocurrency by market value after Bitcoin, was down around five per cent. Solana dropped 8.3 per cent, while Dogecoin was off nearly seven per cent. Since mid-December, “most tokens are now -30-80 per cent, with a few exceptions,” according to digital asset manager Arca.

Article content

“Crypto is just weak, and has been for eight weeks,” said Jeff Dorman, chief investment officer at Arca. “Equities, fixed income, and gold have completely shrugged off any data points that have been used to explain weakness. Only crypto is going lower. And that’s largely due to poor sentiment, exploitation from various memecoin failures, and lack of capital to support new token launches.”

Solana lost nearly US$50 billion in market value in the last month partly as a result of a recent scandal involving Argentina President Javier Milei and a memecoin called Libra, which lost most of its value. Solana is also under pressure with about US$1.72 billion of the token slated to be “unlocked,” or released from trading restrictions, on March 1, according to researcher Messari.

“With continued unlocks and supply hitting the market, folks are just selling,” said Edward Chin, co-founder of Parataxis. “Everyone in that is normally in this market is already fully-long alts, and any new dollars are going into BTC (Bitcoin), which explains its relative strength and the persistence of BTC dominance. There is a lack of a narrative in the altcoin market, so I suspect there will be a continued bleed out until that changes.”

Article content

Bitcoin was down about 1.4 per cent to around US$94,442 as of 1:53 p.m. in New York. The original cryptocurrency seemed to draw some support from Strategy’s announcement on Monday that it spent nearly US$2 billion to buy Bitcoin over the past seven days.

Recommended from Editorial

Ether remained under pressure even with the exchange Bybit saying it replenish all of the the estimated US$1.4 billion it lost to hackers last week. Bybit borrowed some Ether and appears to have purchased some Ether, according to a repost on X from chief executive Ben Zhou.

Shares of crypto-related companies were also lower. Coinbase Global Inc. was down for a sixth day. Strategy was off by around one per cent is is a now little changed on the year. Bitcoin miner MARA Holdings Inc. was about 2.6 per cent lower after slumping 13 per cent last week.

Share this article in your social network