The sources of uncertainty have shifted

Article content

Article content

Article content

It looked like Canada was going to get a reprieve yesterday when U.S. President Donald Trump on his first day in office failed to impose the tariffs he had been threatening.

The Canadian dollar jumped 1.25 per cent Monday afternoon and stock futures rose on the hopes that Trump’s trade policies wouldn’t be as harsh as he had promised.

Those hopes were quickly doused, however, when the newly elected president told media later that same day in the Oval Office that a 25 per cent tariff on Canadian imports could go into effect on Feb. 1.

Advertisement 2

Article content

The U.S. dollar soared, the loonie dropped, and this morning European futures are in the red with investors once again fretting about the inflation risks from tariffs, said Ipek Ozkardeskaya, senior analyst at Swissquote Bank in her morning note.

“Welcome to Trump 2.0 during which investors will be served a good dose of adrenaline, volatility and unpredictability.”

Canada too could face a wild ride this year, and it appears to be getting to Canadians.

In the Bank of Canada’s consumer survey out yesterday, almost half of Canadians expect a recession in the coming year and 58 per cent are uncertain about where the economy is heading.

The sources of that uncertainty have shifted, said the central bank. A year or so ago Canadians were worried about punishing interest rates and government policies; now they are grappling with the uncertainty of global tensions, including the new U.S. administration.

The gloom was even thicker in a poll by Bank of Montreal. Here 63 per cent of Canadians said they fear there will be a recession in the next 12 months.

Despite easing inflation and interest rate cuts by the Bank of Canada, rising prices and the cost of living continue to be the top concerns in the BMO poll. Over two thirds of respondents said that inflation was having a negative impact on their financial situations.

Article content

Advertisement 3

Article content

Forty-four per cent said they were spending an extra $100 to $300 a month on basic living expenses and 38 per cent said they were spending over $300 a month extra.

They were also worried about rising prices in the future, with 61 per cent saying they expected prices to continue rising.

Trump, tariffs and the 51st state

Donald Trump inauguration as the 47th president of the United States on Monday could usher in a new age of uncertainty for Canada. Will he make good on his tariff threat? What about his musings about making Canada the 51st state? Bring your questions to our live interactive Q&A Wednesday at noon and learn more about the issues facing Canada. Register now to receive a reminder ahead of the event with a link to the chat.

Sign up here to get Posthaste delivered straight to your inbox.

Amid the hoopla of President Donald’s inauguration yesterday and fears of the tariff storm to come, the Bank of Canada’s business outlook survey offered a small glimpse of optimism.

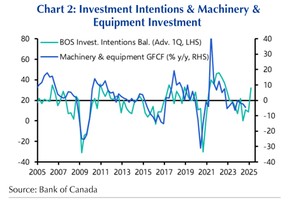

The central bank’s indicator rose for the third quarter in a row to the highest level since early 2023, and investment intentions, as shown in Capital Economics’ chart above, climbed to their highest since the Bank of Canada started raising rates in March, 2022.

Advertisement 4

Article content

“The upshot is that the Bank’s latest surveys paint a brighter picture of the economic outlook than has been the case for some time, even if there are downside risks further ahead,” said Stephen Brown, deputy chief North America economist for Capital.

- Prime Minister Justin Trudeau will speak with media today from a cabinet retreat focused on defending Canadian interests and strengthening Canada-U.S. relations.

- Statistics Canada will release its consumer price index report for December

Canada is facing one of its most serious threats in decades, this time from its closest ally, the United States. Investing pro Martin Pelletier offers some defensive moves for investors if Canada feels the full weight of President Donald Trump’s tariffs. Find out more

Calling Canadian families with younger kids or teens: Whether it’s budgeting, spending, investing, paying off debt, or just paying the bills, does your family have any financial resolutions for the coming year? Let us know at wealth@postmedia.com.

Advertisement 5

Article content

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s YouTube channel for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Article content