Article content

LOS ANGELES — Nvidia Corp. on Wednesday reported a surge in fourth-quarter profit and sales as demand for its specialized Blackwell chips which power artificial intelligence systems continued to grow.

Article content

For the three months that ended Jan. 26, the tech giant based in Santa Clara, California, posted revenue of US$39.3 billion, up 12 per cent from the previous quarter and 78 per cent from one year ago. Adjusted for one-time items, it earned 89 cents a share.

Article content

“Demand for Blackwell is amazing as reasoning AI adds another scaling law — increasing compute for training makes models smarter and increasing compute for long thinking makes the answer smarter,” Nvidia founder Jensen Huang said in a statement.

Wednesday’s earnings report topped Wall Street expectations. Analysts had been expecting adjusted earnings of 85 cents a share on revenue of US$38.1 billion, according to FactSet.

Article content

The fourth-quarter earnings are the company’s first report since Chinese company DeepSeek boasted it had developed a large language model that could compete with ChatGPT and other U.S. rivals, but was more cost-effective in its use of Nvidia chips to train the system on troves of data.

The frenzy over DeepSeek caused US$595 billion in Nvidia’s wealth to vanish briefly. But the company in a statement commended DeepSeek’s work as “an excellent AI advancement” that leveraged “widely-available models and compute that is fully export control compliant.”

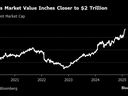

The poster child of the AI boom, Nvidia has grown into the second-largest company on Wall Street — it is now worth over US$3 trillion — and the stock’s movement carries more weight on the S&P 500 and other indexes than every company except Apple.

Recommended from Editorial

Nvidia and other companies benefiting from the AI boom have been a major reason the S&P 500 has climbed to record after record recently, with the latest coming last week. Their explosion of profits has helped to propel the market despite worries about stubbornly high inflation and possible pain coming for the U.S. economy from tariffs and other policies of President Donald Trump.

Share this article in your social network