Analysts say it’s a ‘no-brainer’ way to diversify energy exports away from the United States

Article content

Article content

Article content

Expanding the Trans Mountain pipeline for a second time may sound like someone’s idea of a wild fever dream, but Donald Trump‘s tariff threats and musings on Canada becoming the 51st state have left leaders scrambling for ways to cut our dependence on our now-volatile neighbour.

Citing the risks posed by Trump’s currently delayed 10 per cent tariff on energy imports from Canada, analysts at the Bank of Nova Scotia say that undertaking a second expansion of the controversial 1,180-kilometre pipeline is one of the most expeditious and cost-effective ways to diversify energy exports away from the United States.

Advertisement 2

Article content

“Pursuing a Trans Mountain expansion should be a no-brainer,” the team at Scotiabank Global Equity Research said in a note published on Monday that examined additional expansion opportunities for the pipeline, adding that “the looming threat of 10 per cent tariffs on Canadian energy has once again highlighted its reliance on U.S. markets.”

It’s a bit of a shocking turn of fortune for the Trans Mountain pipeline expansion (TMX), which began operating in May 2024, but was seen as an albatross around the federal government’s neck prior to that. Ottawa purchased the project after Kinder Morgan Inc. decided to back out over regulatory hurdles and rising costs associated with the expansion.

Justin Trudeau’s Liberal government bought the pipeline, which transports crude to the west coast for export to the U.S. and Asia, for $4.5 billion in 2018, only to watch the costs balloon to $34.2 billion.

Since the tariff crisis exploded, Scotiabank analysts say they have been inundated with questions about the feasibility of reviving rejected projects such as Northern Gateway and Energy East.

Article content

Advertisement 3

Article content

“We see little chance of these mega-projects being revived,” they said.

Instead, they think provincial and federal governments should “support and expedite” expanding the TMX because it will benefit the country and narrow the price differential between heavy Canadian crude oil and the U.S. benchmark West Texas Intermediate.

“We see a further expansion of Trans Mountain as positive for Canadian energy producers and the country overall,” Scotiabank said.

The analysts think time is of the essence, which is an idea that meshes with what’s happening in British Columbia. Premier David Eby recently opened the door to expediting resource initiatives by announcing the province was fast-tracking 18 projects to shift its reliance away from the U.S.

Scotiabank proposed two ways to expand the TMX: adding a chemical to reduce the drag on flows, which would require some mechanical work and permitting, and upgrading pumping stations to increase flows.

Trans Mountain Corp., which operates the TMX, previously said the pumping work could be done in four years to five years, but Scotiabank is hopeful that expedited permitting could shorten that timeframe to approximately two years.

Advertisement 4

Article content

Analysts are so worried about the threat posed by tariffs that they don’t think the pipeline’s owner should make expansion contingent on shipping commitments.

“In this case, one could argue that this should not be a gating factor for the owner, as having excess pipeline capacity to offshore markets is a very inexpensive insurance option for the Canadian economy,” they said.

The pipeline has a capacity of 890,000 barrels per day, but it was still running under capacity prior to the tariff threat.

However, an executive at Trans Mountain said the company thinks it’s possible TMX could fill up this year if tariffs come to pass. Otherwise, Trans Mountain expects the pipeline to hit capacity in 2028, a Bloomberg report said.

Also, Trans Mountain’s CEO recently indicated the company was looking at adding 250 million barrels per day to bring capacity to 1.13 million barrels per day.

“We would not be surprised if optimizations beyond this level could be realized as well,” Scotiabank said.

If the price tag for the completed expansion still stings, Canadian taxpayers can take some solace from a report by the Parliamentary Budget Officer (PBO) that placed TMX’s value at $33.4 billion if shipping contracts are renewed.

Advertisement 5

Article content

The PBO said it remains unclear whether the government can make a profit by selling the pipeline, something that has been the Liberals’ stated intention.

Analysts think expanding, or having the pieces in place to expand again is a worthwhile investment that will make TMX more attractive to sell.

“Who the ultimate owner of the Trans Mountain pipeline is remains unclear, and we do not expect any movement on this file until 2026 at the earliest,” they said. “However, if the government is looking to maximize the value of the asset, we believe it would be prudent for the pipeline to be expanded, or at the very least, have a very clear path to expansion.”

Sign up here to get Posthaste delivered straight to your inbox.

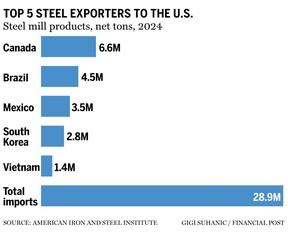

United States President Donald Trump on Monday said he is implementing 25 per cent tariffs on aluminum and steel imports from all countries, replicating a policy move he used in his first term against Canada with mixed results.

Now, insiders in those sectors are hoping to draw on past experience to formulate a more effective counter response as Trump ignites another trade war with them. The new rates will go into effect on March 4, according to a U.S. government official.

Advertisement 6

Article content

- Today’s Data: Statistics Canada releases building permits data for December.

- Earnings: Shopify Inc., Cineplex Inc., Organigram Holdings Inc., TMX Group Ltd., Intact Financial Corp., First Quantum Minerals Ltd., Toromont Industries Ltd., Silvercorp Metals, Inc., Brookfield Residential Properties Inc.

Everyone needs a plan for when they start aging — and that includes financial advisers. They get old, too, and now there’s a law that came into effect in the new year requiring them to make contingency plans in case they die while still actively managing people’s money. Keep reading to find out more from Jason Heath.

Calling Canadian families with younger kids or teens: Whether it’s budgeting, spending, investing, paying off debt, or just paying the bills, does your family have any financial resolutions for the coming year? Let us know at wealth@postmedia.com.

McLister on mortgages

Advertisement 7

Article content

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Read them here

Canada is at an economic crossroads. The FP Economy: Trade Wars newsletter brings you the latest developments from the Financial Post and across the Postmedia network every weekday at 7 p.m. ET. Sign up for free here.

Financial Post on YouTube

Visit Financial Post’s YouTube channel for interviews with Canada’s leading experts in economics, housing, the energy sector and more.

Today’s Posthaste was written by Gigi Suhanic, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Recommended from Editorial

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content