Bitcoin reached a new record high on Monday, pushing the estimated fortune of its creator, Satoshi Nakamoto, above $133 billion. The milestone comes as investor demand and institutional activity continue to drive the cryptocurrency market.

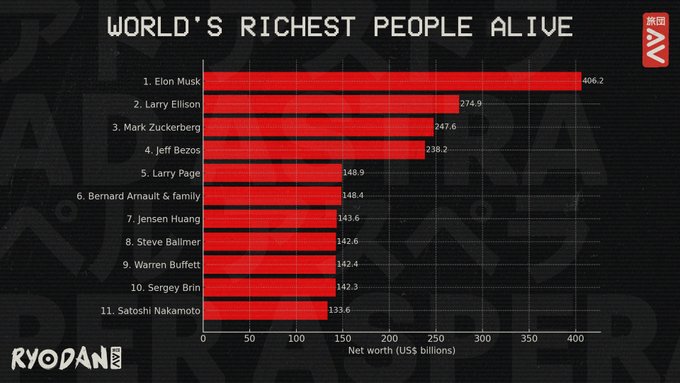

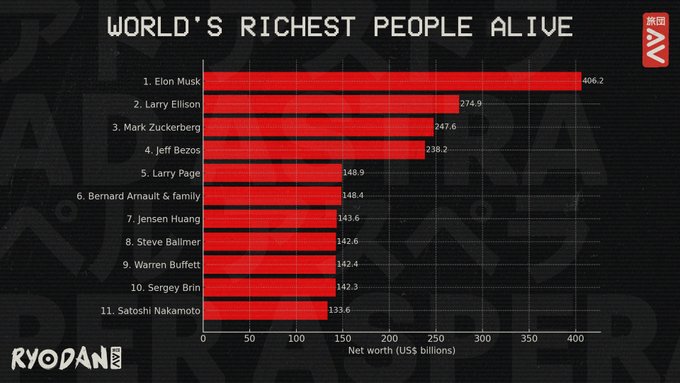

Satoshi Nakamoto, the unknown individual or group behind Bitcoin, has never moved their holdings. These coins were mined during the early development of the network and have stayed untouched for over 14 years. The sharp rise in Bitcoin’s value has now placed Nakamoto 11th among the top wealthiest people globally.

Bitcoin Hits Record Price Driven by ETF Demand

Bitcoin’s price rose past $123,000 this week, setting a new all-time high. The rally is being attributed to strong demand from institutional investors and continued inflows into Bitcoin-focused exchange-traded funds (ETFs). Analysts say the interest from these large firms has played a key role in recent market momentum.

According to blockchain data, Satoshi Nakamoto holds around 1.1 million BTC. With the current price levels, this amounts to more than $133 billion in value. These holdings were mined between 2009 and 2010, when the Bitcoin network was in its earliest stages and operated by only a few people.

BlackRock, one of the world’s largest asset managers, has also been increasing its exposure to Bitcoin. New data shows BlackRock now holds around 700,439 BTC, making it the second-largest holder behind Nakamoto.

Satoshi Nakamoto Wallet Remains Dormant Since 2010

Despite the growing value of their holdings, none of the coins in Satoshi Nakamoto’s known wallet have ever been moved.

The coins are publicly traceable on the blockchain, and their continued inactivity has led to ongoing discussions about Nakamoto’s identity. The Bitcoin creator’s last confirmed public communication occurred in 2011. Since then, there has been no verified contact.

Consequently, the crypto community has continued to debate whether Nakamoto is alive or has chosen to remain silent to preserve Bitcoin’s decentralization.

Bitcoin’s Market Value Nears $2.5 Trillion

As Bitcoin reaches new highs, the total market capitalization of the cryptocurrency has climbed to nearly $2.5 trillion. This puts it on par with some of the largest public companies in the world surpassing even Amazon to rank 5th largest.

Institutional interest is also rising due to concerns about inflation and currency devaluation. Many large companies are including Bitcoin as part of their treasury strategies. Strategy (formerly MicroStrategy), for example, now holds 600,000 BTC after a recent $472 million purchase.

This buying pressure continues to fuel Bitcoin’s price, and some analysts believe it may reach even higher levels if current trends continue. The US House is preparing to vote on multiple crypto-related bills, which could further influence BTC price trend.

Consequently, despite Satoshi Nakamoto being 11th in the world, if Bitcoin continues to rise, he could surpass Elon Musk’s wealth. According to the Kobeissi Letter, a Bitcoin price of $370,000 would make Nakamoto the richest known or unknown person in the world.

“Bitcoin could actually produce the first anonymous richest person in the world,” wrote The Kobeissi Letter in an X post.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

✓ Share: