Solana price remains below the $200 mark as market uncertainty lingers, intensifying bearish pressure. The broader crypto market has seen corrections, impacting major assets like Bitcoin (BTC), which now trades near $96k. Whale activity, including a $5 million SOL withdrawal, suggests cautious sentiment. Investors closely watch economic indicators, with markets likely to remain range-bound until the next CPI report provides further direction.

Solana Price Breaks Below $200 as Whale Withdraws $5M in SOL

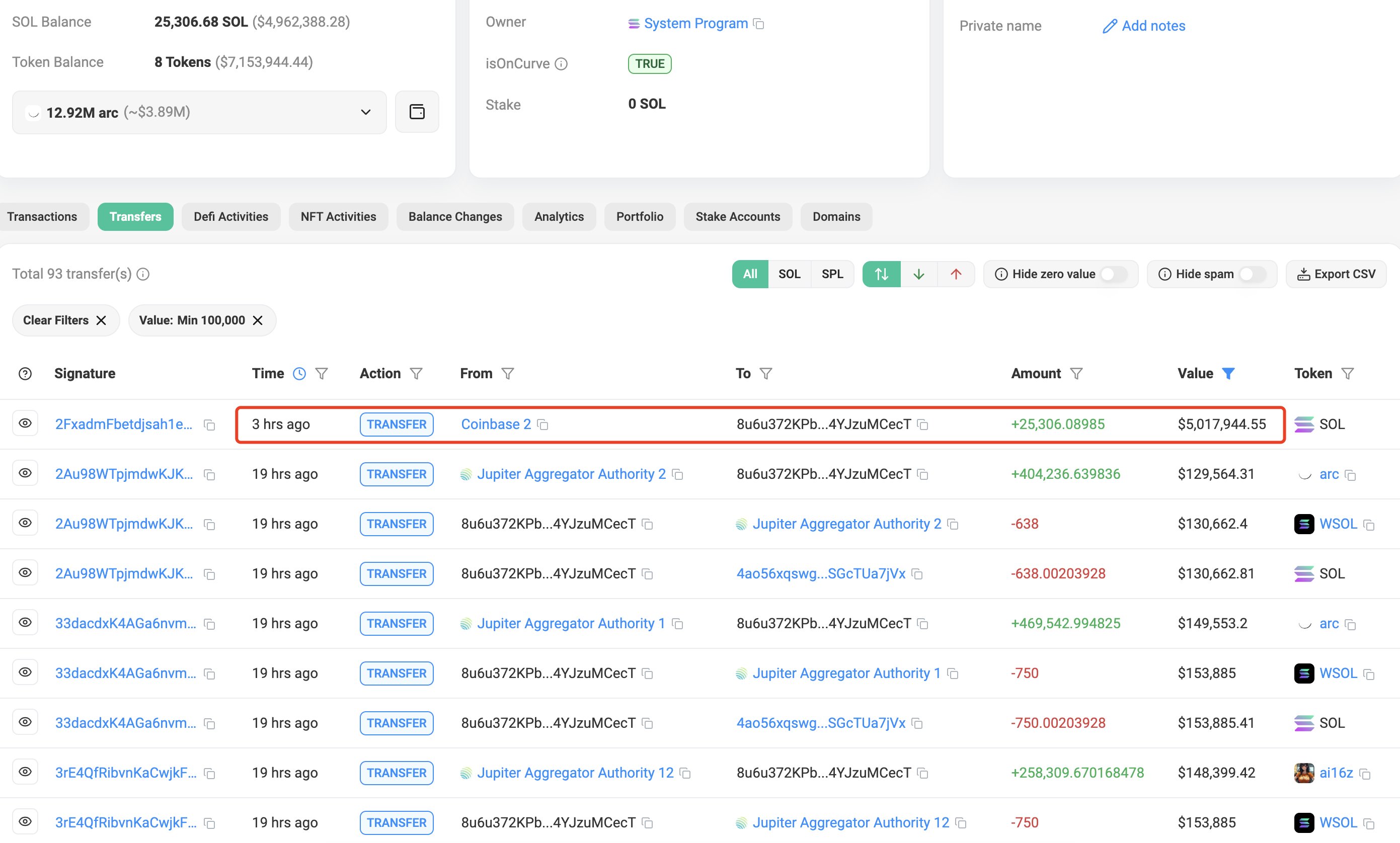

Lookonchain data reveals that a prominent whale withdrew 25,306 SOL, valued at $5 million, from Coinbase within three hours. The movement suggests the investor may be accumulating more AI-related tokens, which could impact the Solana Price.

This follows a significant purchase made a day earlier when the same entity spent 38,138 SOL, worth approximately $7.8 million, acquiring ARC and Ai16z tokens. The large-scale transactions indicate continued interest in AI-driven crypto assets. Solana’s price recently dipped below the $200 mark amid increased whale activity.

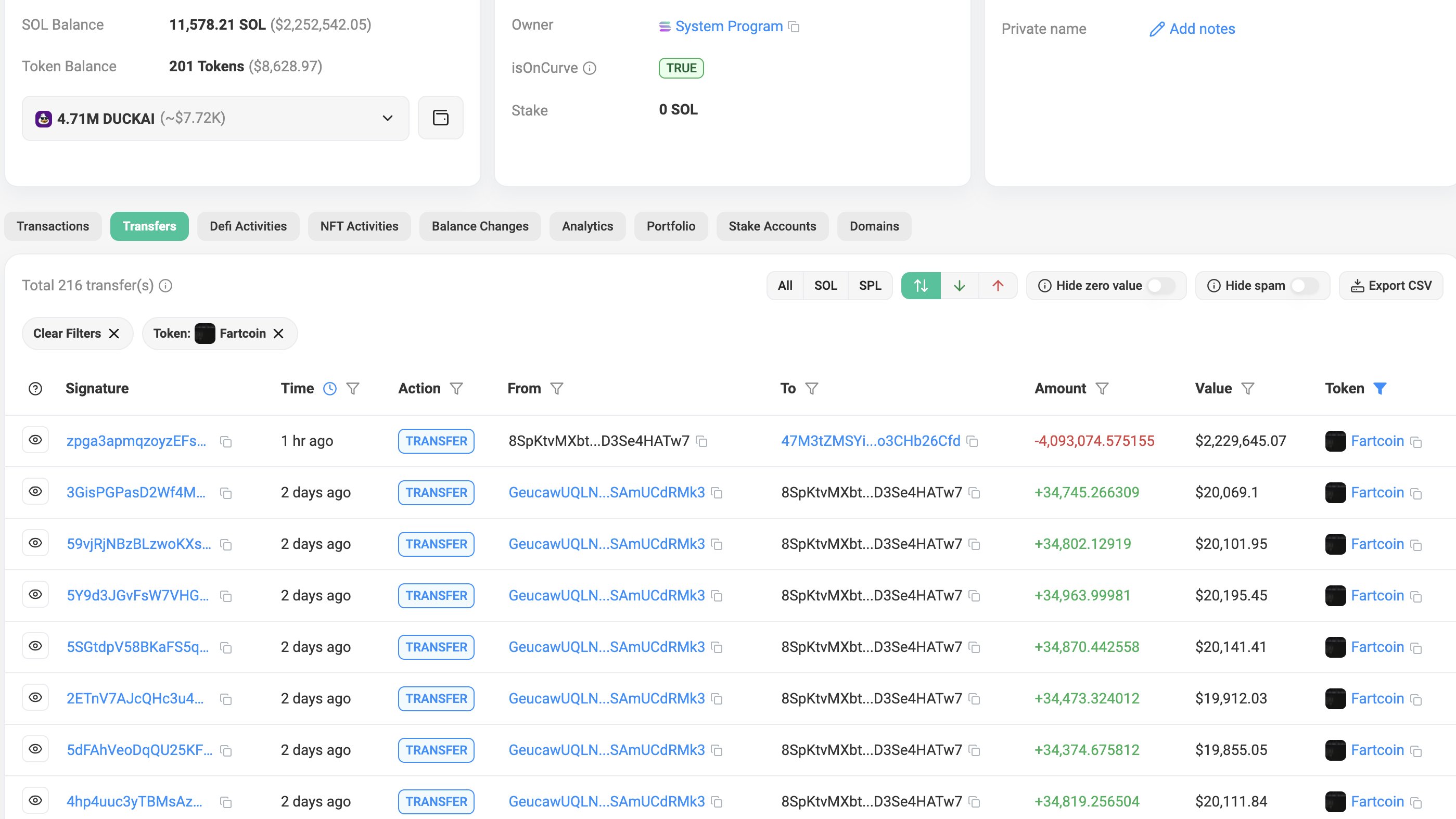

Additionally, the Lookonchain data indicates that a large investor offloaded 4.09 million Fartcoin for 11,578 SOL, valued at $2.26 million, just an hour ago. The sale resulted in a significant loss of approximately $2.21 million.

Transaction records show the whale accumulated these tokens between January 19 and February 10, purchasing them at an average price of $1.09. The steep loss suggests a shift in strategy or a reaction to market conditions.

The move comes amid heightened volatility in the cryptocurrency market, where sudden large-scale sell-offs can impact liquidity and investor sentiment.

Solana Price Slips as Crypto Market Faces Fresh Turmoil

Solana price has dropped below $200 as the cryptocurrency market struggles amid economic concerns. BTC dipped to $95k, fueling bearish sentiment. Altcoins like ETH and XRP also faced declines, reversing earlier gains.

The downturn follows macroeconomic developments ahead of the upcoming consumer price report, which could signal persistent inflation. Market volatility remains high, with investors closely monitoring economic data and broader financial trends for further direction.

Will Bulls Reclaim $200 or Drop to $180?

SOL’s value today is $196, showing a slight increase of 0.43% in the last trading session. The cryptocurrency consolidates around key support and resistance levels, indicating a possible breakout in either direction.

Solana price prediction faces resistance at $200, with stronger levels at $230 and $250. On the downside, support is holding near $180, preventing further decline. If buyers fail to push the price above $200, a drop to $180 could be imminent. However, a break above $200 may trigger a rally toward $230.

The MACD indicator shows a bearish momentum, with the MACD line positioned below the signal line. This suggests weakening buying pressure and the potential for further downside if momentum does not shift. The RSI is at 43, signaling that SOL is in neutral territory but closer to oversold conditions.

In conclusion, the Solana price remains under $200 as market uncertainty lingers. Whale activity and broader crypto trends will determine the next move, with support at $180 and resistance at $200. If the crypto market recovery and BTC price resume above $100k , most of the cryptos could witness a rebound fueling the surge.

Frequently Asked Questions (FAQs)

Solana’s price declined due to broader market corrections, whale activity, and macroeconomic uncertainties affecting investor sentiment.

The large withdrawal signaled potential accumulation but also contributed to short-term market uncertainty and volatility.

As a major cryptocurrency, Bitcoin’s price direction often influences altcoins like Solana, affecting liquidity and investor sentiment.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: