Stocks whipsaw as U.S. duties are implemented and then partially walked back

Article content

Article content

Article content

Cracks are appearing in United States President Donald Trump‘s tariff plans and upset investors could be playing a role in that.

North American investors have made it clear they aren’t onside with Trump’s “beautiful” tariffs. Any gains from the so-called Trump trade after the president was elected on Nov. 5 have evaporated as tariffs cause massive uncertainty — the very thing investors despise.

Advertisement 2

Article content

Trump imposed his 25 per cent tariffs on Mexico and Canada earlier this week, but it didn’t take long for him to start walking back his economy-crushing agenda.

On Thursday, Trump signed an executive order delaying tariffs for Canada and Mexico until April 2 on goods covered by the United States-Mexico-Canada Agreement. The day before, Trump also gave North America’s Big Three automakers a month-long break on the tariffs.

Is this a case of Trump seeing the light on tariffs or investors having their way with the chaos-causing president?

At the moment, Sadiq Adatia, chief investment officer at BMO Global Asset Management, doesn’t think investors are so much responding to the idea of tariffs as they are to the constant changes that are occurring.

“The market wants certainty, whether it is 15 or 20 or 10 per cent tariffs,” he said. “They want to know so they can price it because companies don’t know what to do. They don’t know whether to build plants in Canada or China or in the U.S. They don’t know how much costs are going to be.”

Adatia said he thinks there will be tariffs but at a lower rate and that once they are resolved, the uncertainty will come out of the markets.

Article content

Advertisement 3

Article content

On the president’s side, economist David Rosenberg said Trump cares very much about the markets.

“If you remember, in Trump 1.0, he tweeted about the stock market every day when it suited him. So to Donald Trump, the stock market is the benchmark yardstick for his success,” the founder of Rosenberg Research & Associates Inc. said. “He is a former real estate mogul, but he watches the stock market constantly.”

Adatia agrees that Trump measures his success by the stock market’s performance.

“Trump also evaluates himself on how well the market does,” he said. “He feels he wins in the market.”

But 47 days into Trump’s second term, he has been mum on the stock market.

Rosenberg thinks the reason for that is because the S&P 500 was up 10 per cent at a similar stage in Trump’s first term.

U.S. officials have tried to put some distance between themselves and what’s happening on Wall Street, with U.S. Commerce Secretary Howard Lutnick saying the administration was more interested in Main Street rather than Wall Street.

“That was beyond just disingenuous because Wall Street and Main Street have never been joined at the hip more than they are today,” Rosenberg said, noting that U.S. household exposure to markets has “never been as high” as it currently is, particularly through the 401(k) — America’s version of the registered retirement savings plan.

Advertisement 4

Article content

Overall, U.S. households hold 70 per cent of their financial assets in equities, 10 per cent in bonds and the remainder in cash.

“If you’re talking about Main Street, there’s a lot riding on what happens on Wall Street, more than has ever been the case in recorded history,” Rosenberg said.

Looking not too far ahead, Adatia thinks Trump is OK with the current market volatility and evaporated year-to-date returns, though the Nasdaq corrected on Thursday.

“I don’t think he’s responding to the markets quite yet,” he said. “Right now, he’s continuing down his path and still believing that tariffs are the right way to go, even if it causes some pain.”

Adatia thinks the president’s agenda will reset if markets are down 10 per cent to 20 per cent at year-end.

Sign up here to get Posthaste delivered straight to your inbox.

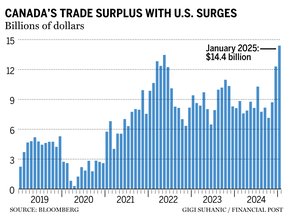

Canada’s exports to the United States surged in January on shipments of cars, auto parts and energy, pushing the northern nation to post a record trade surplus with the U.S.

Canada’s exports to the United States surged in January on shipments of cars, auto parts and energy, pushing the northern nation to post a record trade surplus with the U.S.The country’s merchandise trade surplus with the U.S. widened to $14.4 billion in January, from $12.3 billion in December, Statistics Canada said Thursday. Exports to the U.S. surged 7.5 per cent in January and set a record for a second consecutive month.

Advertisement 5

Article content

“Trump’s tariff talk is already shaking up trade,” he said in an email. “U.S. buyers are scrambling to stock up on Canadian goods, pushing exports higher as they rush to beat the tariffs. This inventory stockpiling could backfire if the tariffs don’t last, but given the chaos, that seems unlikely,” Andrew DiCapua, economist at the Canadian Chamber of Commerce, said. — Bloomberg

- Thirty U.S. and Canadian mayors and other local elected leaders from the Great Lakes and St. Lawrence River Basin hold a press conference on the U.S.-Canada trade relationship.

- Today’s Data: Statistics Canada and the U.S. Bureau of Labor Statistics release jobs data for February

- Earnings: Athabasca Oil Corp., Open Text Corp., Martinrea International Inc., Artis Real Estate Investment Trust

Here’s an interesting tax tale. You are a Canadian citizen. You go to Libya to work as an engineer. Before returning home to Canada, you decide to put $431,000 in a Swiss bank account, but you don’t report it to the Canada Revenue Agency as “foreign property.” Keep reading to find out what happens next.

Advertisement 6

Article content

Calling Canadian families with younger kids or teens: Whether it’s budgeting, spending, investing, paying off debt, or just paying the bills, does your family have any financial resolutions for the coming year? Let us know at wealth@postmedia.com.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s YouTube channel for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Gigi Suhanic with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Recommended from Editorial

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Article content